Aging Europe: Rising costs threaten EU pensions

- Hge News

- Aug 15, 2024

- 2 min read

Europe's population is aging fast, forcing EU states to spend more on pension benefits. While governments want to raise the retirement age, savers are calling for a more flexible approach.

Europe's demographic time bomb has been ticking for decades, with societies of European Union countries growing older and people living longer. More than a fifth of the European Union's population is now aged 65 or older. That figure is expected to reach a third by 2050. The World Health Organization warned last year that 2024 would mark the first time that over-65s would outnumber Europe's under-15 population.

Despite large increases in immigration over the past two decades, the continent still needs to attract enough workers whose taxes can help cover the growing cost of public pensions. Economists predict that by 2050, there will be less than two workers in Europe for every retiree, compared to three now.

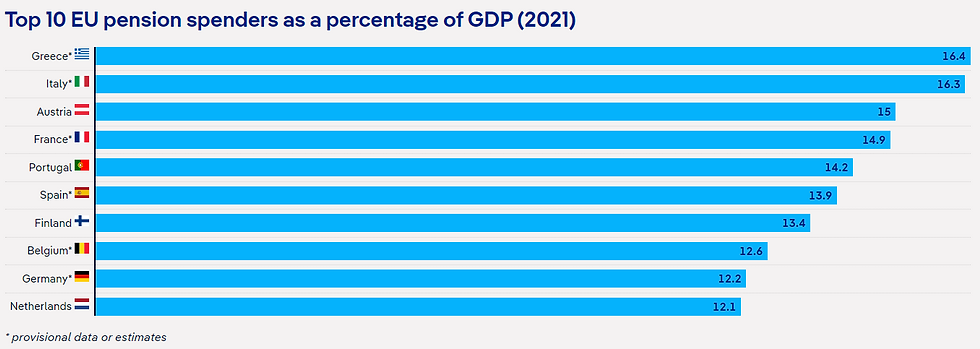

Meanwhile, the annual public pension bill has reached more than 10% of gross domestic product (GDP) in 17 of the EU's 27 states — all but one of them in Western Europe. In Italy and Greece, pensions cost public finances more than 16% of GDP.

Raising retirement age irks workers

To help address the exorbitant and rising costs, several EU states have tinkered with their public pension systems, including by raising their retirement age. France, for example, faced months of angry protests last year over plans to force older workers to retire at 64, up from the current age of 62.

Other European countries have gone further, including the United Kingdom, which plans to keep people working until 68 from the mid-2040s onward. Women in Britain used to retire 5 to 7 years earlier than men, but a move to equalize the pension age sparked compensation demands for the affected women.

"The Dutch have recently reformed their pension system, but it's not achieving the set goals," Hans van Meerten, a European pension law professor at Utrecht University, told DW. "Also, in Germany, Belgium and many other European countries, I don't see the necessary reforms. They are digging their own graves."

Added to the strain on Europe's public finances, millions of people are still not saving enough in private or occupational pensions meant to complement their state pensions. Data from the Eurobarometer last year showed that only 23% of EU residents have an occupational pension scheme and just 19% own a personal pension product. The figures vary hugely between EU states.

A separate survey by the Insurance Europe trade body found that 39% of respondents are not saving for retirement — the figure was even higher among women and workers over 50. Many of those that do are frustrated with their investment outcomes.

Low returns, inflation hurt savers

"Over the past decade, Europe's pension crisis has significantly worsened due to persistently low real returns that have not been sufficient to outpace inflation," Arnaud Houdmont, director of communication at the Brussels-based investors' body Better Finance, told DW. "That has resulted in a substantial loss of purchasing power for savers."

Comments