Volatility in crude prices to rise in runup to Doha output review meet

- Ismail Sharif

- Mar 25, 2016

- 2 min read

Oil prices have surged more than 50 per cent from their 12-year lows since the Organisation of Petroleum Exporting Countries (Opec) floated the idea of a production freeze, boosting Brent up from around $27 a barrel and US crude from around $26.

This positive momentum continued in the past fortnight, wherein Brent and WTI gained by around 4.5 and 9.5 per cent, respectively. MCX oil prices rose by 8.5 per cent in the same time frame. The depreciation of the rupee by around 0.81 per cent also supported the rise on the MCX. Opec kingpin Saudi Arabia and non-Opec producers led by Russia will meet on April 17 in Qatar capital Doha, aiming for the first global supply deal in 15 years.

Optimism that major producers will strike an output freeze deal next month amid rising crude exports and gasoline demand in the United States will keep investors on the edge in the near term. On the contrary, technical pressure and worries that US crude stockpiles were still growing amid falling output and refinery maintenance are factors capping oil prices. Although the recent agreement by big oil producers to ease global oversupply is a move in the right direction in order to prop up ..

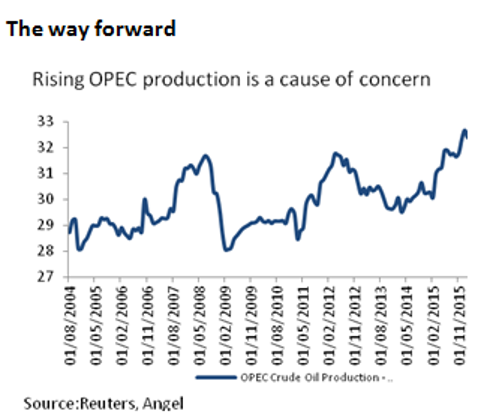

They continue to pump in excess of 31 million barrels a day in the past two months creating further supply glut globally. The way forward In the coming fortnight, oil prices are expected to remain volatile and trade higher in anticipation of further cuts in oil production by Opec and non-Opec producers although US's crude inventories of around 522 million barrels remains a cause of concern for investors across the world over. On the other hand, the Commodity Futures Trading Commission

We expect WTI oil prices (CMP: $40.92/bbl) to rise in the coming fortnight which can move higher towards the $46 a barrel level while Brent (CMP:$41.36/bbl) can move higher towards $48. MCX oil prices (CMP: Rs 2,758/bbl) can move higher towards Rs 2,850 a barrel in the same time frame.

Comments